Examine This Report on Hard Money Lenders

Table of ContentsThe Ultimate Guide To Private Money LendersLenders Near Me for BeginnersThe Single Strategy To Use For Hard Money LendersHard Money Loan Can Be Fun For AnyoneEverything about Hard Money Lenders OregonPrivate Money Loans Fundamentals Explained

If you back-pedal the funding, you'll lose the property you present to protect the car loan. There are several choices to tough cash fundings. If you have a difficult cash finance, you could make use of one of these to replace it:.These lendings are typically made use of in the realty sector. Some capitalists purchase houses in demand of repairs, fix them up, and after that offer them for a revenue. This is referred to as flipping as well as can be difficult to get financing for. Various other genuine estate capitalists might use difficult cash loans for business or rental homes if they can not discover traditional financing.

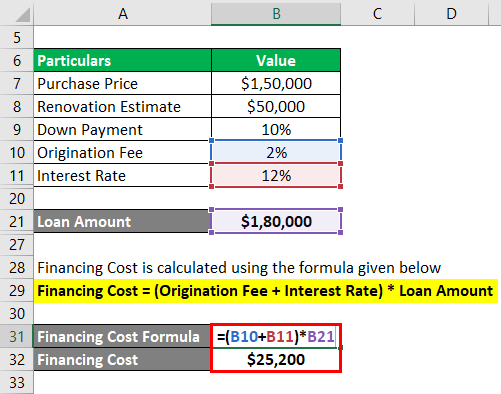

You use them as a quick method to obtain cash for a purchase. You wouldn't want to maintain one of these finances for an extended duration because rate of interest rates for tough money are normally fairly high. For circumstances, the average passion rate for hard cash fundings in 2020 was 11.

The Single Strategy To Use For Precision Capital

With traditional proportions, lenders understand they can market your building fairly swiftly and have an affordable opportunity of obtaining their cash back. Tough money lendings make the many feeling for short-term car loans. Fix-and-flip financiers are an excellent example of hard cash customers: They have a building just long enough to enhance it, raise the building worth, and offer it as quickly as they can.

What Does Hard Money Lenders Do?

It may be possible to make use of difficult money to purchase a home that you wish to live in. You could, but you 'd wish to refinance as soon as you can get a lending with lower rates as well as a longer finance term. Commercial Loans. To discover a difficult money funding, you'll require to speak to establishments concentrating on this kind of deal.

Difficult money financings are finances offered by personal lenders for investment functions. The rates for these financings are usually greater, and the terms are much shorter than typical financings. The possession you're taking the financing out for comes to be the security for the financing, so the lending institution's threat is reduced.

3 Easy Facts About Private Money Loans Shown

The meaning of "tough money" when described in realty financing, is essentially a car loan safeguarded by a property instead of the consumers financials, credit rating, and so on. The name difficult money is often interchanged with "no-doc", exclusive fundings, bridge loans, private money lendings, and so on, For a difficult cash lending, the underwriting choices are based upon the customer's hard possessions (realty).

There are other sorts of tough money financings on supply, devices, etc but considering that we concentrate on genuine estate, we will not enter into these variations right here. Considering that the loan provider is not depending on consumers credit history, see here now and so on the possession is evaluated to make sure there is adequate security to protect the lending.

in contrast to tough money's key dependence on the difficult realty possession. In addition to requiring substantially more documentation, conventional lenders. In addition to needing significantly more my mortgage documents, traditional lenders. have minimum credit rating (normally mid 600 Fico as well as over) as opposed to tough money fundings that are financing on the collateral as opposed to the customers credit report (Fairview Lending has actually shut loans with FICO ratings in the low 400s).

The Single Strategy To Use For Commercial Loans

Residential small business loan usually take around 45-60 days while we can enclose as low as 5 days. The final important differentiator in between tough cash as well as traditional financing is the rates of interest. Because there is even more risk in a true security based loan, the rates of interest are more than a traditional home loan.

A hard lending is an "asset secured" funding that is offered by a personal fund or financier. A Difficult Cash loan is an excellent idea depending on your circumstances as well as goals.

Yes, a hard cash lender pulls credit rating. On of the key reasons is to verify identity as well as see if there is anything on the debtor's credit history that might influence the car loan like a tax obligation lien or reasoning. At Fairview, my key focus is not the credit report as we are concentrating mainly on the property.

The 25-Second Trick For Private Money Loans

This should be defined plainly in the car loan commitment as well as the loan documents/mortgage - Fix and Flip. Due to the speed of closing (5-10 days) most hard cash car loans are considered comparable to a money transaction. Yes, if a residential or commercial property is detailed available a difficult money loan provider can give a loan.

When choosing a hard money lending institution, you require to be mindful. Like navient lawsuit any purchase if something appears as well great to be true it likely is. Concentrate on a local loan provider and also verify using the BBB, google testimonials, and googling the business to guarantee they are a truthful loan provider. Normally, tough cash car loans are rate of interest just as they are suggested to be used momentarily period.

For Fairview, we simply require fundamental property info to get begun. We finance all our fundings in residence and can quickly tell you yes or no on a handle a fast telephone call or e-mail.